Circulus Family Office Summit

Before we get to today’s podcast, we are happy to announce our first full day event for family offices in New York on September 19th! 🎉

Circulus is building on its successful digital platform of newsletters (5150 subscribers) and popular podcasts (number 12 in family office podcasts globally) to bring family offices face to face to engage with the power of ideas and build enduring relationships.

This is our first step towards building a global community and invite single family offices to APPLY for an invitation.

We are thrilled to have Steven Tananbaum of GoldenTree joining us, and we also have some surprise speakers to be announced, so stay tuned. We will cover private equity, family wealth, fintech and the global macro outlook. This will be a very special event. If you are a single family office, we hope you can join us!

Ken Kencel - The Art of the Covenant

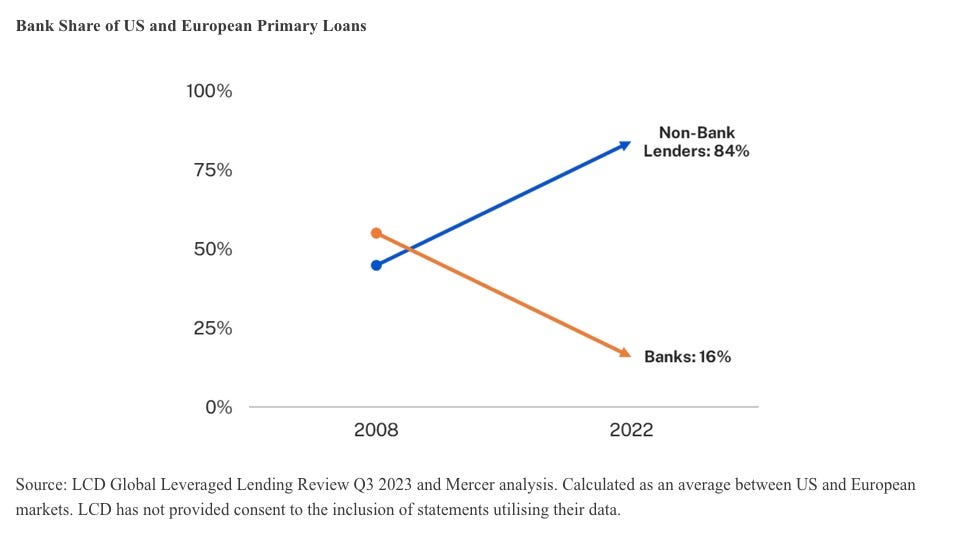

It is hard to overestimate the growth and importance of private credit in the larger ecosystem today, and its importance in institutional and family office portfolios. The growth in the space is well illustrated in this chart:

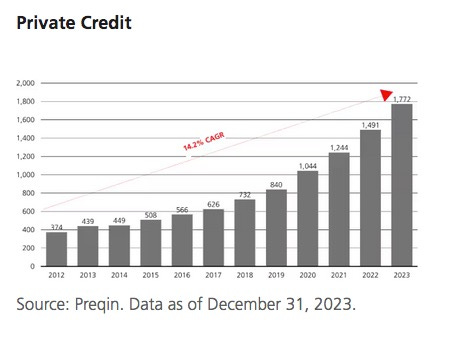

Although these are all loans, private credit to PE sponsors is now approaching 2 trillion:

Ken gives us a master class on the space and the business of private credit itself. Ken Kencel is the President & CEO of Churchill Asset Management, a $50 billion dollar platform serving over 700 institutional clients. He shared valuable insights on the growing private credit market, the evolution of the industry, his first job at Drexel, working at Carlyle, and then going out on his own to start Churchill from scratch. We also discuss the nuances of the art of the covenant and finish with Ken’s desert island discs.

My two biggest takeaways today were the importance of scale and the impact of digitization, something I have heard echoed many times from other players.

Ken started his career in M&A at Drexel Bernham Lambert, founded the high yield finance business at Chase Securities, and was head of leveraged finance at RBC as well as Indosuez Capital. He was president and CEO of Churchill Financial Group, which was sold to Carlyle where he served as a Managing director before starting Churchill Asset Management. Ken graduated with a magna cum laude from Georgetown and has a JD from Northwestern.

Please enjoy my conversation with Ken Kencel.

Apple Podcasts listen HERE.

Links

If you are interested in going deep into private credit, I can’t recommend this extended post enough. It is amazing how much of the credit business came out of one desk in Beverly Hills: The Definitive History of Private Credit.

Who is propping up the commercial real estate market? It may be family offices: Commercial Observer - The Super Rich and Family Offices Are Changing Real Estate Capital Markets

Family offices are set up to preserve family wealth and perpetuate a family’s philanthropic legacy, and are often managed rather conservatively. It is disconcerting to see the story of Archegos used to call for more regulation. Archegos clearly misled their lenders in some cases, and in others their counterparties were willfully blind to the risks they knew they were taking. Archegos is a story of a cowboy who bet it all, not a call for more family office restrictions: Bloomberg - Archegos Trial Dredges up 2 Trillion Family Office Dispute.

Apparently there are now 300 family offices in India according to PwC. This number seems off by a few multiples. Anyone know of better numbers? SME Times - India now has over 300 Family Offices from 45 in 2018 with smaller cities in focus: Report

Thanks for reading! Please like and share with your friends.

Share this post